At the beginning of the year, there was optimism about global economic growth, but the recent banking crisis has changed this. The IMF has lowered its forecast for global economic growth and cited financial market volatility as a factor behind this change in outlook….

«We are entering a dangerous phase in which economic growth remains low by historical standards and financial risks have increased, but inflation has not yet turned a decisive corner.» So says Pierre-Oliver Gourinchas, chief economist at the IMF.

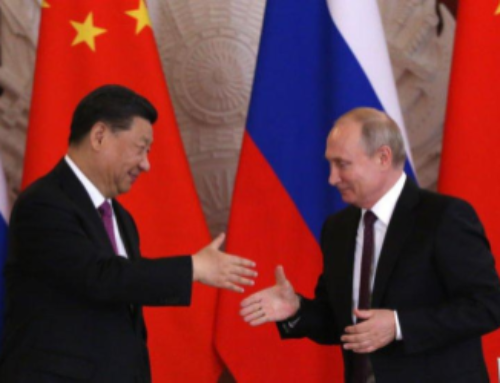

The destabilization of the banking system as a result of the rise in interest rates in the fight against inflation, which is much more resistant than expected, has led to this negative forecast. The IMF maintained that the cumulative effects of the pandemic and the impact of the war unleashed by Russia in Ukraine still persist.

Global growth of 3.4% in 2022 is reduced to a forecast of 2.8% in 2023 and 3% in 2024, down a tenth in each case from last January’s forecasts, the lowest medium-term forecast in many years.

The report stresses that, in the event of a systemic financial crisis, careful and timely policy adjustment will be necessary to protect both the financial system and economic activity. It emphasizes that regulators and supervisors must act quickly in such situations to prevent them from developing into a full-scale financial crisis.